Editor’s Note (10/8/20): At the October 7 vice presidential debate, Kamala Harris and Mike Pence tussled over the Green New Deal. Several proposals have fallen under that banner. How many jobs would one of them create? What kinds of jobs? Scientific American has detailed data on these questions.

Political candidates in the U.S. have been announcing plans to address climate change at a record pace. With the mounting recognition of local, national and global threats, they want to show they are ready to act. At the same time, elected officials are releasing various forms of carbon tax legislation. These initiatives are rekindling debate about how much of a price to put on carbon and what effects the options would have on the environment and the economy.

Increasingly, the action plans and tax proposals cite estimates of their employment impacts. Among Democratic presidential primary candidates, for example, Senator Elizabeth Warren of Massachusetts claims that her plan would create 1.2 million jobs in green manufacturing, while former vice president Joe Biden and Senator Bernie Sanders of Vermont say their proposals would provide jobs in the 10-million-to-20-million range. At the other extreme, President Donald Trump has claimed that nationwide climate-change policies would be “totally disastrous, job-killing.”

Some pundits say we cannot save the planet without stalling economic growth. Yet there is mounting evidence that both environmental and economic goals can be met. At the center of this argument are several proposals falling under the banner of a green new deal, as well as the Energy Innovation and Carbon Dividend Act (EICDA) of 2019. Our independent review of a Green New Deal (GND) proposed by the U.S. Green Party suggests it is possible to rapidly lower CO2 emissions while also expanding employment over the next three decades by an additional 35 million job years (one job for one year). Yet a more moderate tax on carbon could be economically more attractive.

A False Choice between Climate and Jobs

It has become nearly axiomatic that efficient climate policies must put a tax on carbon emissions. In the energy sector, a huge source of human CO2 emissions in the U.S., levying taxes on the carbon content of fuels would move investments to cleaner energy sources and more energy-efficient practices. Emitters could choose their preferred carbon-reduction approach, and policy makers could adjust the tax as social damages from climate change evolve.

Many policy analysts argue that taxing carbon emissions from fossil fuels will foster economic growth and employment opportunities by boosting sales in labor-intensive clean-technology work and by promoting innovation. This logic is at the heart of the GND as proposed by the Green Party. It prescribes a transition to 100 percent clean energy by 2030—achieved in part by taxing CO2 emissions starting at $60 per metric ton, with annual increases and additional policies to ensure a socially just change. Meanwhile the EICDA now in the House of Representatives starts with a $15 tax per metric ton of CO2,which grows by $10 or $15 a year, depending on future levels of carbon emissions.

Critics have dismissed the GND as a green dream, arguing that the carbon tax would impose costs on society and cause job losses, particularly in fossil-based energy sectors. Others assert that the timing is just too accelerated. For example, in an interview for NPR in February, former Obama administration secretary of energy Ernest Moniz said, “I’m afraid I just cannot see how we could possibly go to zero carbon in the 10-year timeframe. It’s just impractical. And if we start putting out impractical targets, we may lose a lot of key constituencies who we need to bring along to have a real low-carbon solution.” The architects of the Green Party’s GND maintain that the initiative would not only avoid a climate catastrophe but that its health savings would, by themselves, ensure that the plan would pay for itself.

Analyses of carbon-tax impacts on U.S. employment are sparse because of the limited history of existing tax schemes. Yet we can assess job impacts by using what is known as a computable general-equilibrium energy-economy model—in particular, the National Energy Modeling System (NEMS), which was created by the U.S. Energy Information Administration (EIA). For more than a decade, the Georgia Institute of Technology has used its version of that model, known at GT-NEMS, to forecast the impacts of energy and climate policies.

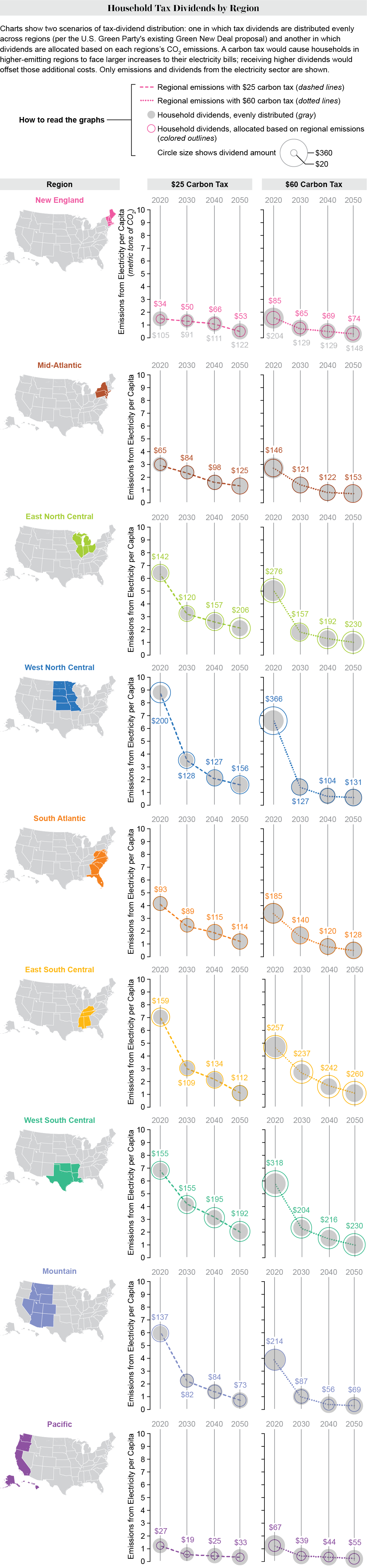

The GND that we modeled starts in 2020 with a tax of $60 levied on each metric ton of CO2 emitted by the U.S. energy system. The tax is set to increase annually at the rate of inflation, plus 5 percent. We also examined a carbon tax starting at $25 and growing at the same rate, allowing a more moderate price to be compared with a higher tax. By 2030, the $25 tax would be $41 per metric ton of CO2 emitted, and the $60 tax would be $98. By 2050, the two taxes would rise to $108 and $259, respectively.

In both scenarios, the tax revenues were returned to households by lowering federal personal income taxes, adjusted as necessary to avoid affecting the national deficit. Recycling tax revenues to households as so-called carbon dividends is a feature of many recent carbon tax proposals, including the GND. To identify the tax impacts, we compared the two scenarios with EIA’s “reference case” forecast, which assumes a continuation of U.S. policies that were in place in 2018 and the introduction of those slated to be enacted after 2018. The reference case includes residential and commercial federal-efficiency standards and future increases to fuel economy and emissions standards for light-duty vehicles through 2025, but it does not incorporate an economy-wide carbon tax in the U.S.

Carbon Taxes Cut CO2 Emissions

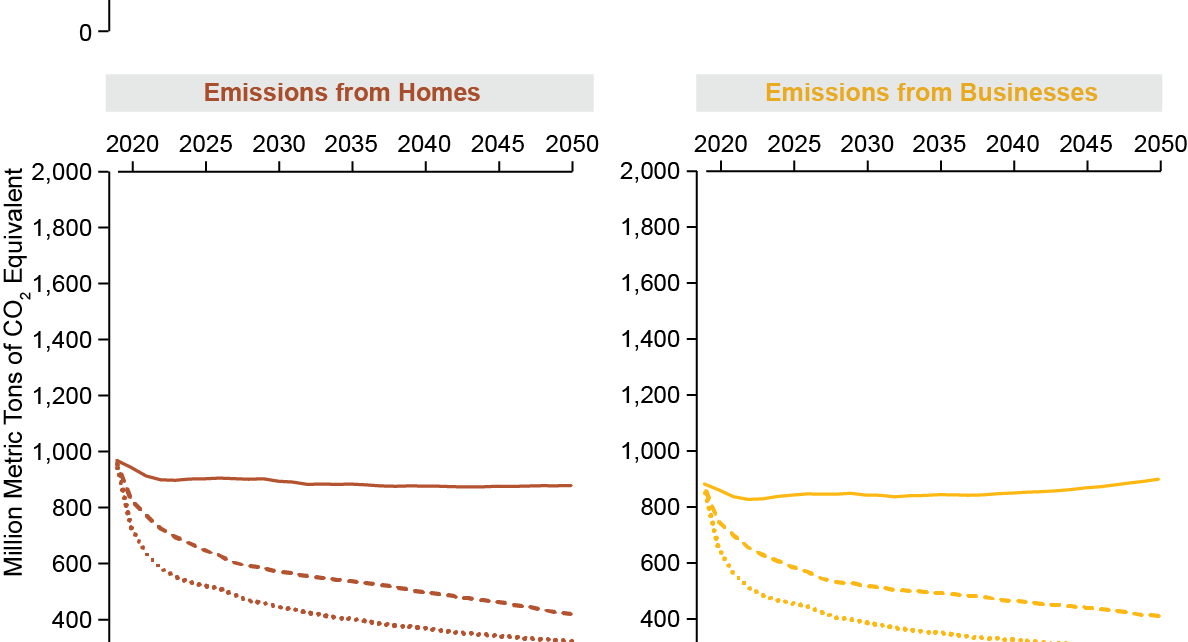

In the absence of a carbon tax, GT-NEMS forecasts that CO2 emissions from the U.S. energy system would be higher in 2050 than they are today. In the short run, the declining use of coal in the electricity sector, the uptick of natural gas, wind and solar power, and improvements in the energy efficiency of homes and light-duty vehicles are expected to cause the country’s overall CO2 emissions to decrease. But by 2030, this decline would taper off because of the growing energy requirements of businesses and manufacturers as the economy continues to expand—in the absence of any new incentives to decarbonize. These scenarios reinforce the importance of strengthening environmental policies. Otherwise, the U.S. will not embrace cleaner resources or curb its energy appetite enough to offset the demands of a growing economy.

In contrast, implementation of a $60 carbon tax would cause U.S. CO2 emissions to decline, relative to the reference case, by 28 percent in 2030 and by 37 percent in 2050.

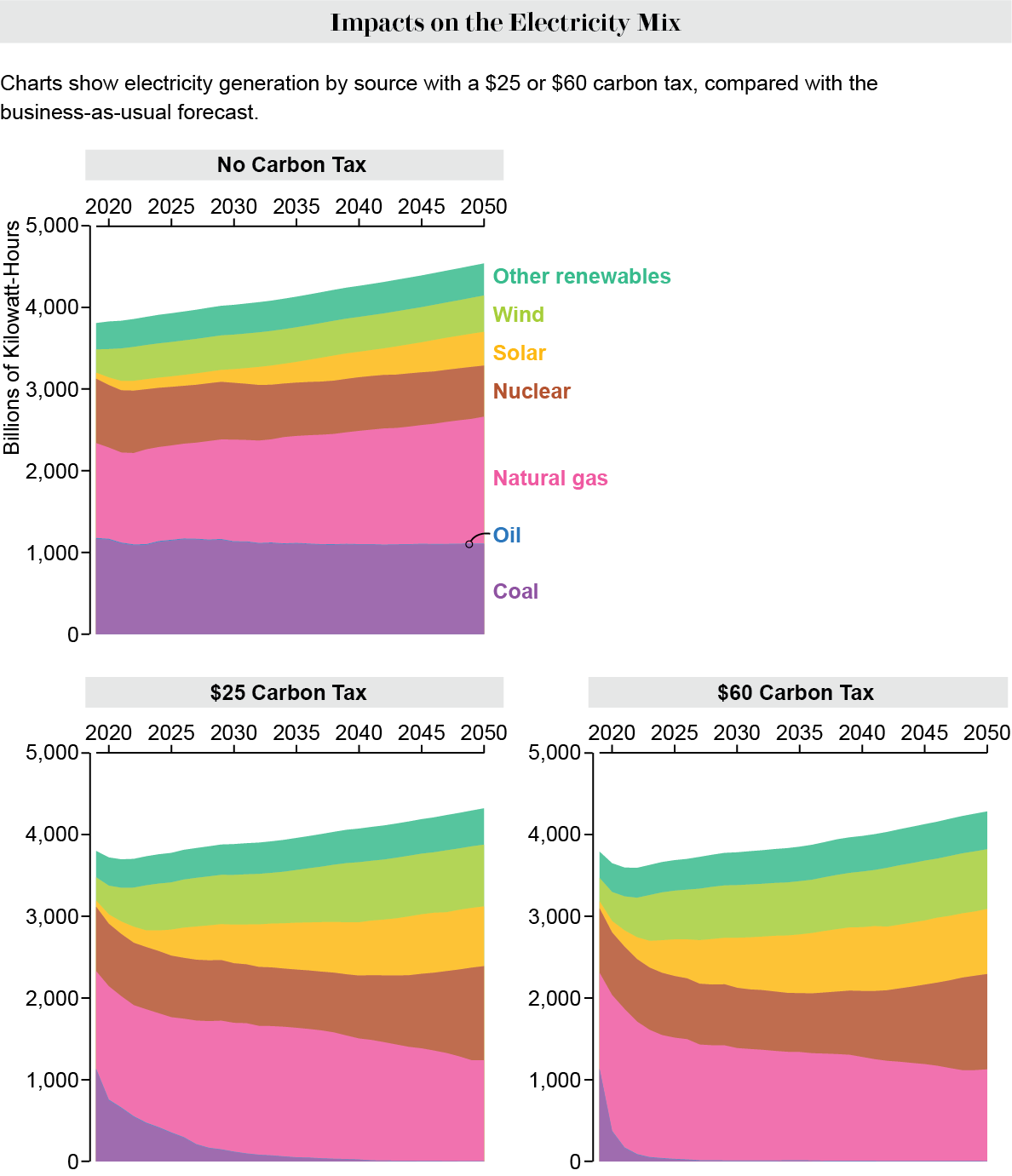

Across the U.S. economy, carbon taxes would transform the electricity system the most. The reference case forecasts that carbon emissions from generating electricity would decline modestly through mid-century, with coal burned to generate power decreasing slightly to 656 million metric tons in 2050. A $60 carbon tax would squeeze coal out of the power sector almost entirely by 2030: as a result, the power sector would experience a 72 percent reduction in CO2, compared with the reference case, in 2030 and an 87 percent reduction in 2050. Even a more modest $25 carbon tax would trigger abundant low-cost clean electricity investments. With a $25 tax, only 119 million metric tons of coal is forecast to be burned in 2030, and it is cut to 62 million metric tons in 2050.

On the other hand, transportation and industry are the economic sectors that would be transformed the least by a carbon tax. They are also the ones that depend the most on petroleum fuels.

Because of the relatively flat trajectory of natural gas prices in the reference case, natural gas used in the electricity sector is expected to increase year after year over the next three decades. Introducing carbon taxes alters that forecast. With a $25 tax, natural gas would peak nationwide in 2031. With a $60 tax, it would peak 10 years earlier, in 2021.

Solar and wind power would grow in the reference case. But with carbon taxes, their market shares would surge quickly. Under both carbon tax levels, nuclear power would experiences= a renaissance, beginning in about 2035 and continuing through 2050, when it would eclipse natural gas as a source of electricity.

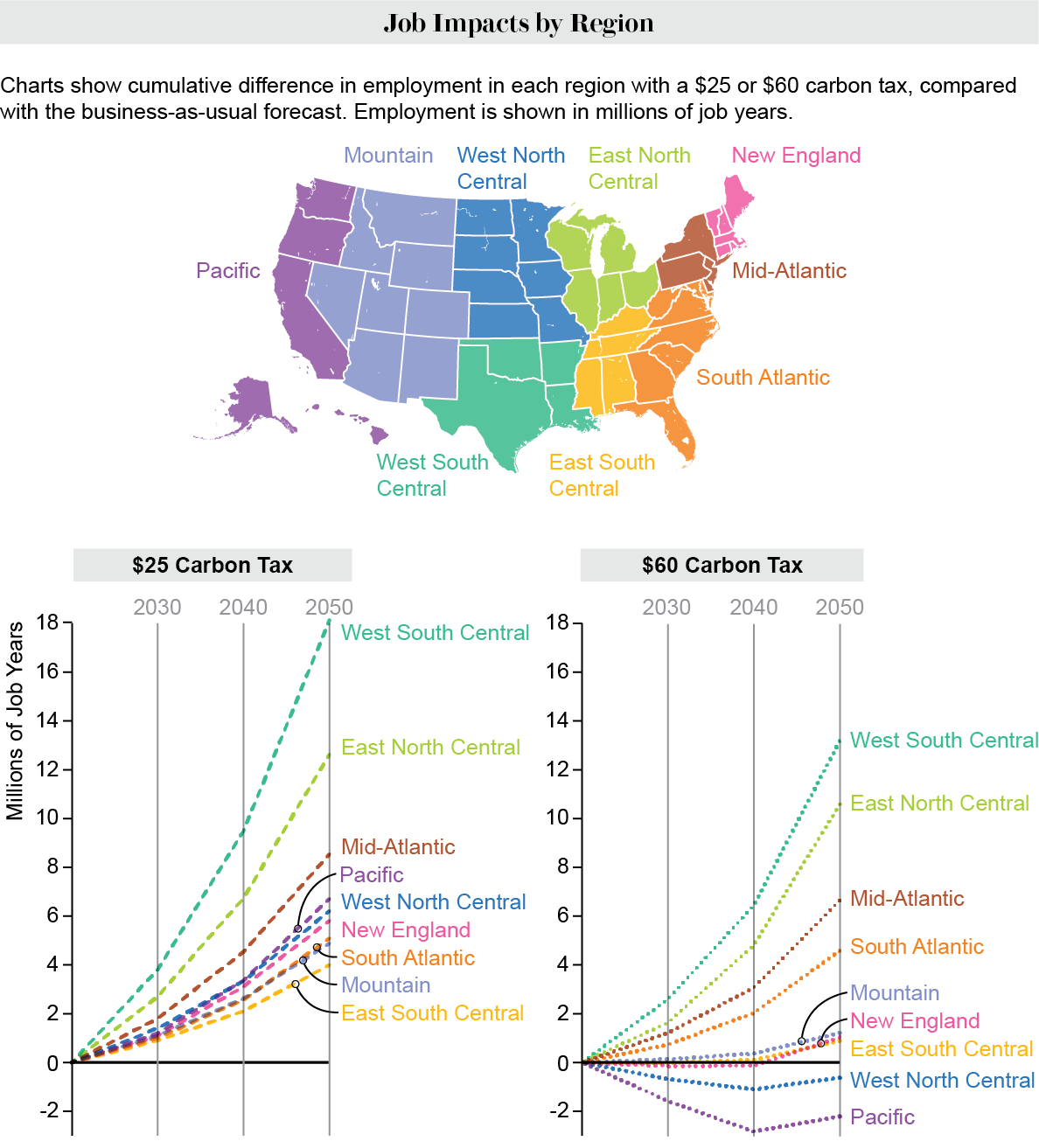

These transformations would not occur uniformly across the U.S. Several factors would vary geographically and shape the costs and benefits of transitioning to cleaner fuels: the amount of fossil fuels and renewable resources; access to pipelines, ports and other supply infrastructures; availability of specialized workforces, including nuclear engineers; and state and local regulations, incentives and financial markets. As a result, some regions would reduce the carbon intensity of their energy systems faster than others.

.png)

Impact on Employment

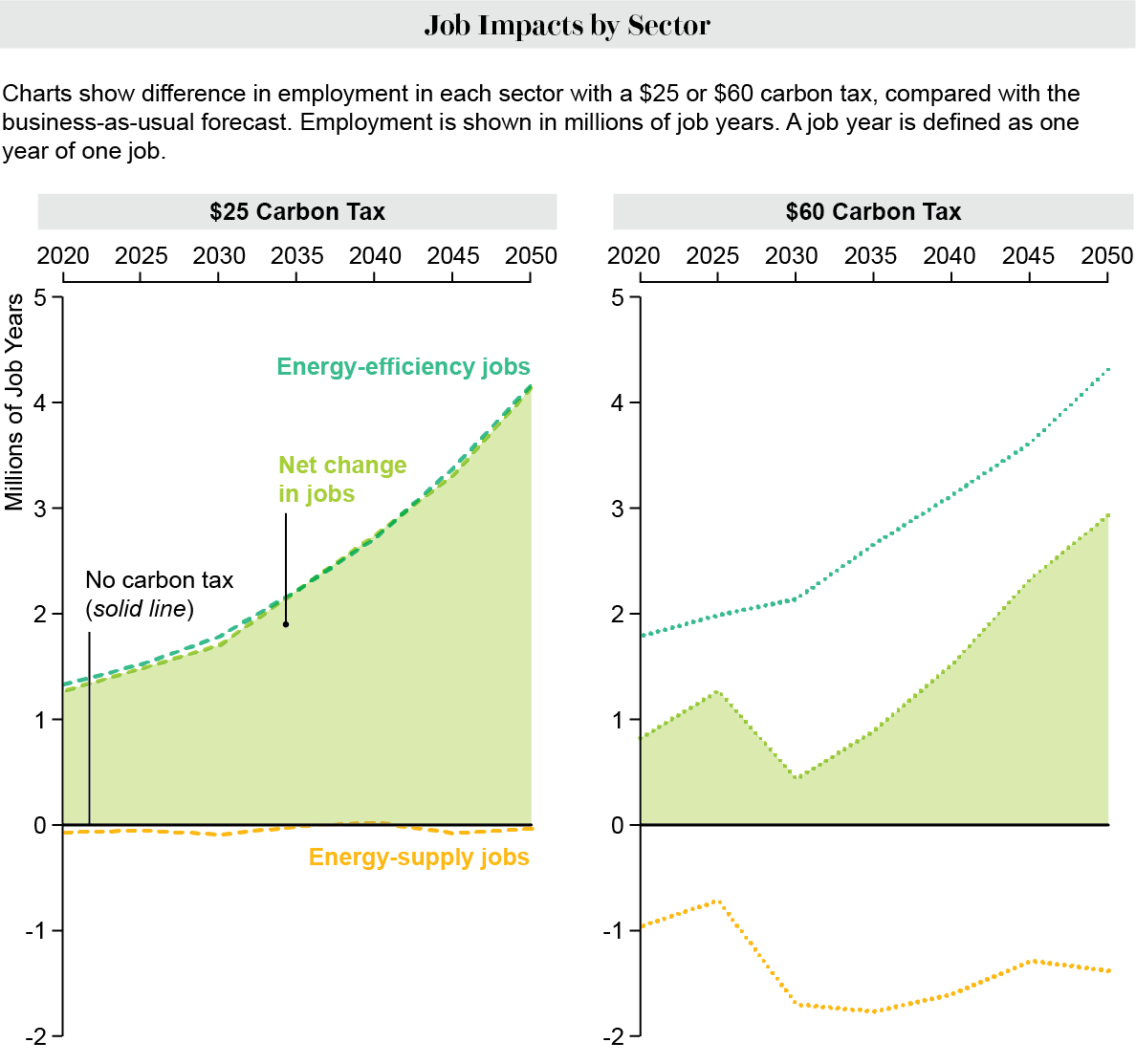

We estimate that the more conservative $25 carbon tax would boost U.S. employment by 1.4 million jobs each year between 2020 and 2030, which is nearly a 1 percent increase above the reference–case forecast of 160 million jobs in 2030. As the economy expands and the tax increases, job growth from the GND would accelerate, creating, on average, 3.4 million new jobs each year between 2040 and 2050—a nearly 2 percent increase above the 182 million jobs forecast for the U.S. in 2050. Overall, it is estimated that 72 million job years would be created over the three decades with a $25 carbon tax. (Note that if one job continues after one year for another 12 months, it represents two job years.)

With the more aggressive $60 carbon tax, U.S. employment would still exceed the reference-case forecast, but the increase would be less than that of the $25 tax. The higher tax causes much larger supply-side job losses, but they are still smaller than the gains in energy-efficiency jobs motivated by higher energy prices. Overall, 35 million job years would be created between 2020 and 2050, with net job increases in almost all regions.

According to the latest data, in 2018 about 9.2 million Americans (5.7 percent of the U.S. workforce of roughly 162 million at the time) were employed in an energy industry. Nearly half of these jobs (about 4.3 million) made up the traditional supply-oriented categories: fuels, including petroleum, natural gas, coal and woody biomass (1.1 million); electric power generation (900,000); and transmission, distribution and storage (2.3 million). The motor-vehicle-related industries employed 2.5 million, and energy efficiency employed 2.4 million.

The GND would cause traditional supply-oriented jobs to decrease, but energy-efficiency jobs would more than compensate for the losses. New jobs from energy-efficiency investments would be significant, totaling 1.8 million in 2030 and 4.2 million in 2050. These estimates reflect the labor-intensity of jobs in construction, which account for more than half of the energy-efficiency workforce in 2018. Other large gains would be associated with heating, ventilation, air-conditioning and refrigeration systems—the largest share of energy-efficiency investments in the residential and commercial sectors. In industry, the greatest investments estimated would be in energy and environmental management and smart controls, followed by industrial-machinery manufacturing such as that of high-efficiency motors and variable-speed drives. The result would be job growth across all nine Census divisions of the U.S., in all three decades with a $25 carbon tax. The $60 tax would boost job growth in the U.S. overall and across a majority of its nine Census divisions and three decades.

Of the Census divisions, the Pacific and West North Central regions would be the only parts of the nation to experience job losses during both the 2020s and 2030s. The New England region is also projected to lose jobs during the first decade as it adjusts to the requirements of the $60 carbon tax. In contrast, West South Central and East North Central would witness the largest increase in energy-efficiency employment in both tax scenarios—and therefore would experience the largest job growth.

How large would the household dividends generated by taxes be? Imposing a $25 tax on each metric ton of CO2 produced in the electricity sector alone would result in national revenue of $35 billion in 2020. A $60 tax would boost it to $68 billion. In aggregate, the resulting household income tax rebates, or “dividends,” would be greater than the increase in household utility bills. Nevertheless, the variation in dividends and bills would be regionally diverse. Dividends could be allocated uniformly across regions, but doing so would disadvantage regions with significant increases in energy prices.

Distributing dividends across households regardless of income, on the other hand, is a progressive feature of these proposed carbon-tax initiatives. High-income households purchase more carbon-intensive goods and services than other income groups. Therefore, low- and middle-income households would generally gain more in dividends than they would pay in increased prices from the introduction of carbon taxes.

A Greener Economy Worth Investing In

The GND offers citizens a vision of how their economy could advance from traditional fossil-fuel dependence to a future powered largely by low-carbon alternatives. Our analysis indicates that a cleaner-energy approach motivated by carbon taxes would promote innovation, open up new markets and produce an economy with more jobs—a greener economy worth investing in.

Today clean-energy technologies in the U.S. struggle to compete because fossil energy is so “inexpensive.” Low prices make it difficult for such alternatives to flourish. Our analysis shows that raising energy prices would empower the transition to efficiency, renewables and other low-carbon resources. Indeed, a carbon tax of either $25 or $60 would cut carbon emissions significantly, but the higher tax would produce quicker and deeper reductions. On the other hand, while both tax levels would grow jobs, the $25 tax would provide more employment growth than the $60 one. Thus, as with most policies, the optimum is a trade-off between competing priorities.

By using the clean technologies that carbon taxes would promote, Americans would not have to travel less, freeze in the winter, take cold showers or cut the output of their manufacturing plants to reduce the U.S.’s carbon emissions. Our independent analysis, along with a growing body of research, suggests that a low-carbon economy is likely to be a stronger and more secure economy that also provides climate solutions.

Editor’s Note (12/19/19): This story was updated to include a graphic showing “Job Impacts by Sector.”