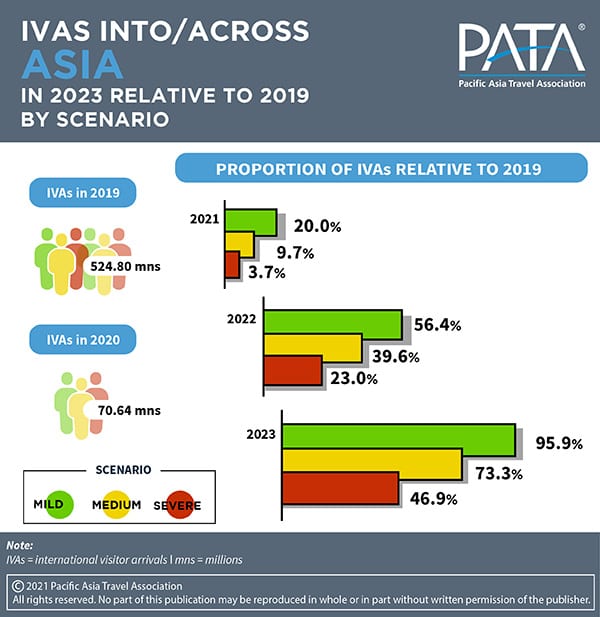

The global travel and tourism industry is fighting for survival. The longer the fight, the more difficult it gets. PATA today released estimated numbers of recovery for 2021/2022/2023 with three scenarios.

- There are three scenarios according to a study released today by PATA for the year 2023 . The best scenario expects 96% of tourism to be back based on 2019

- China, Hong Kong, USA, Thailand – who will be the winners, who will be the looers ?

- PATA CEO counts on vaccines becoming more freely available and inoculations are proceeding rapidly, but even so, and while first results are very encouraging, their effectiveness over a wider proportion of the population has yet to be fully demonstrated.

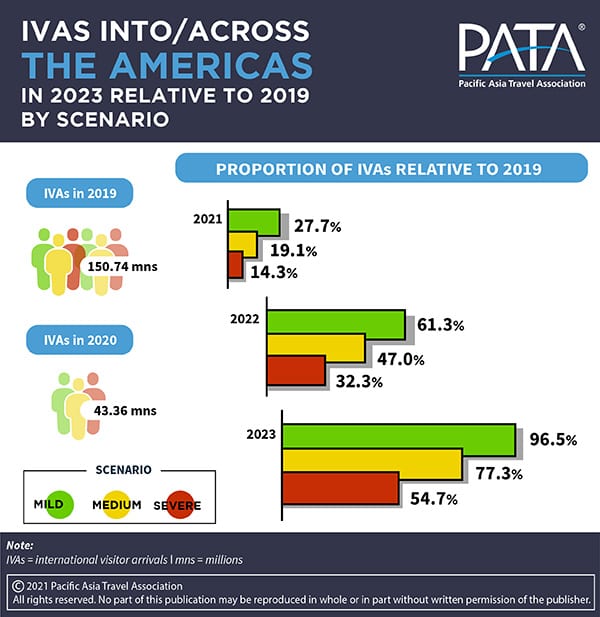

In 2023 the North America, the Caribbean and South America could welcome 96.5% of all international visitors back compared to 2019. In 2022 this number could be 61.3% and 27.7% this year. This is a dream scenario released by the Pacific Asia Travel Association (PATA) today.

A more realistic picture is the medium scenario with 77.3% of international visitors back in 2023, 47% back in 2002, and only 19.1% this year.

Depending on the development with Coronavirus a more severe number would estimate 54.7 % back in 2023, 47% 32.3% in 2022 and 14.3% this year in 2021.

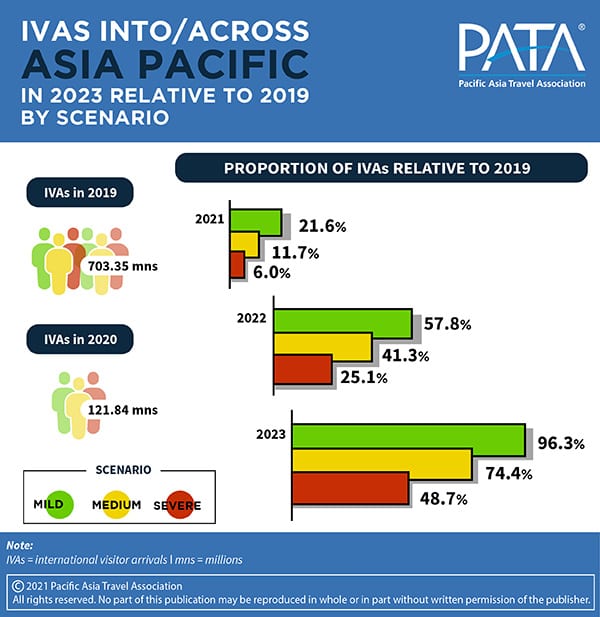

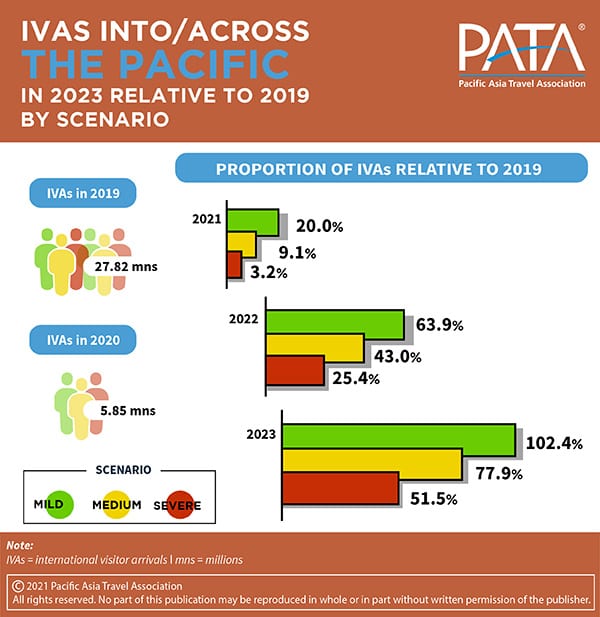

This is according to the full report of the Asia Pacific Visitor Forecasts 2021-2023 released today by the Pacific Asia Travel Association (PATA), where three growth prospects for international visitors into and across 39 Asia Pacific destinations are made, covering mild, medium and severe scenarios.

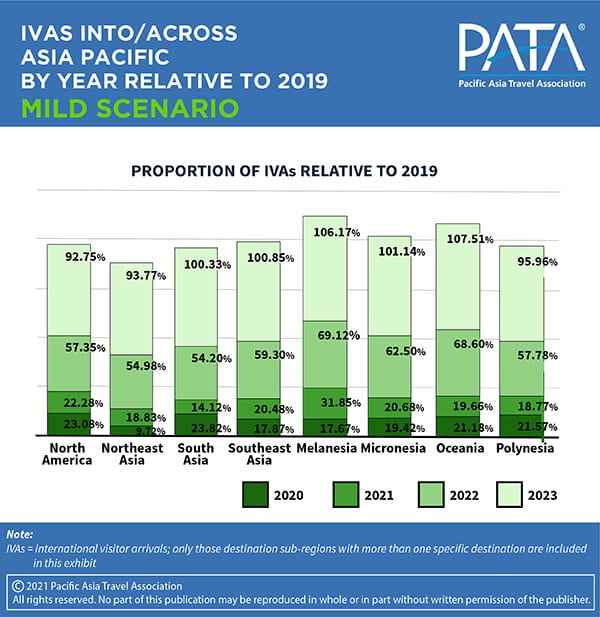

| There is quite a disparity for each of the destination regions of Asia Pacific as well, with the Pacific for example, projected to exceed the 2019 volume of foreign arrivals into that region by a little over two percent in 2023. |

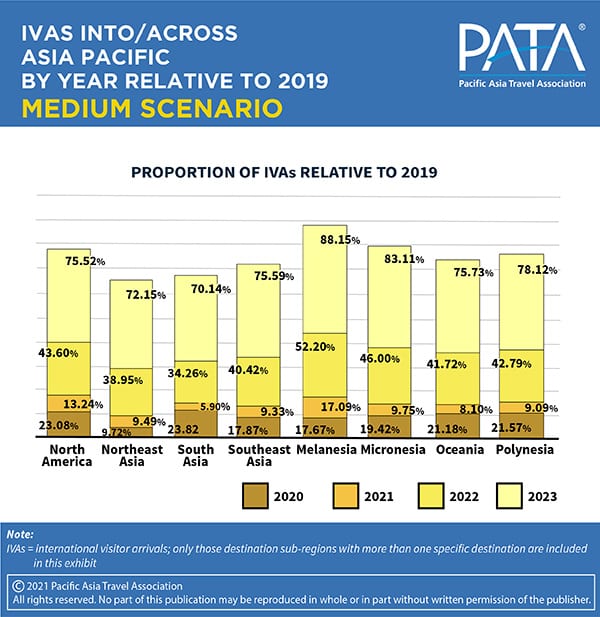

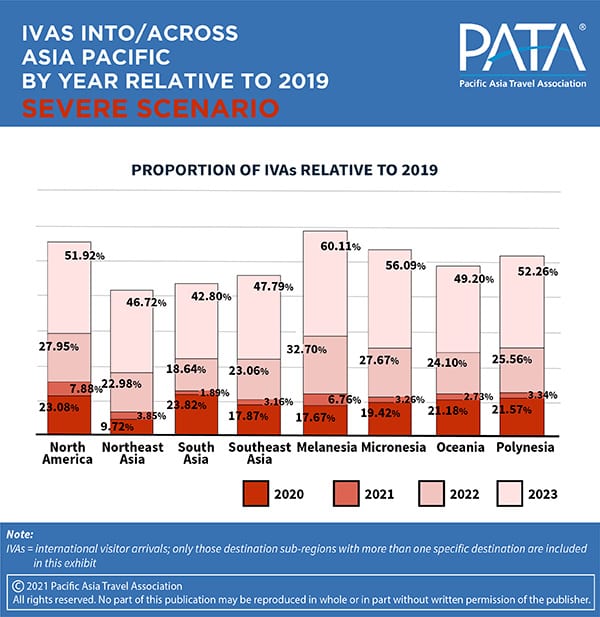

| Under the medium scenario, that proportion is expected to reach around 78% while under the severe scenario it is likely to remain at just 52% of the 2019 volume.

The Americas is in a somewhat similar situation, however, as the 2023 proportion of IVAs relative to that of 2019 is still expected to fall short under the mild scenario although only by a minimal margin. |

| The medium and severe scenarios present a similar reduction in the proportions of IVAs in 2023 relative to 2019, to those of the Pacific.

Asia, known as a powerhouse for international arrivals into and across the Asia Pacific region will experience similar figures to what is expected for the Americas under the mild scenario. However, the medium and severe scenarios could fall back even further. In the latter scenario for example, the report projects that IVAs into and across Asia Pacific could fall back to less than half of the 2019 volume by 2023. |

| Of immediate concern, for all of the Asia Pacific destination sub-regions under each of the scenarios, 2021 is likely to be another difficult year for international travel movements. Any growth is likely to be extremely uneven, and for some sub-regions may be further below the levels of 2019 and even those of 2020. |

| South Asia in particular, under this mild scenario, is expected to lose even more IVAs with its relative proportion to 2019, falling to around 14% in 2021, before rebounding strongly in 2022 and 2023.

Under the medium scenario, more destination sub-regions are expected to fall into further decline in 2021 relative to 2019, before turning to some tentative recovery in 2022 and 2023. |

| Furthermore, 2021 is anticipated to be remarkably challenging under the severe scenario. |

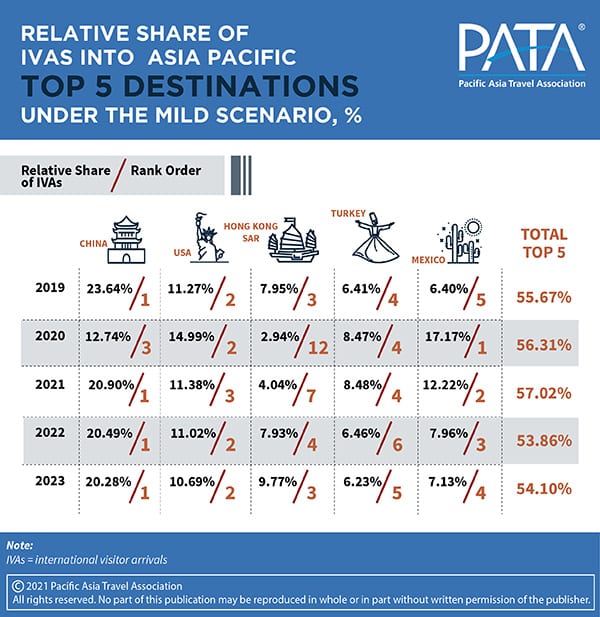

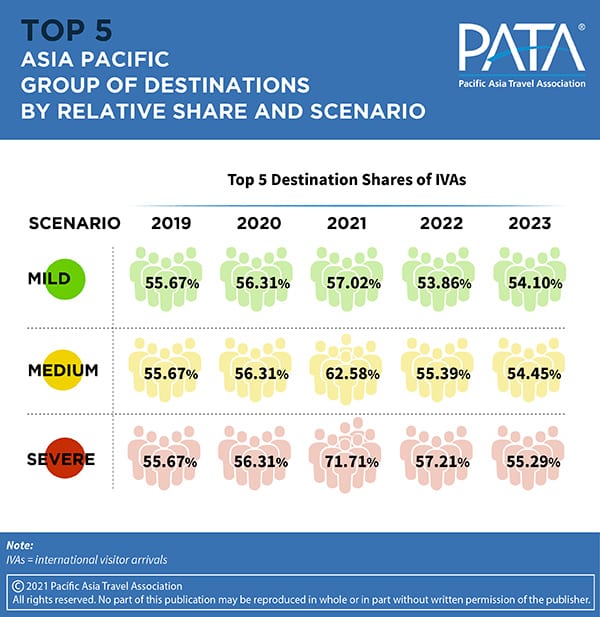

| At the destination level, the top five Asia Pacific markets by volume of IVAs received do not change much in order of importance and hold relatively steady positions under each of the scenarios. While there are some rank order changes, these are minimal. In addition, under each scenario, the top five destinations routinely account for more than half of the total IVAs into the region. |

| Of interest is the finding that China fell from its position of dominance in 2020, but is expected to regain this position from 2021 onwards. Under the severe scenario, this takes a little longer with China returning to the first position in 2022. Similarly, Hong Kong SAR, which after falling to the 12th position in the rankings in 2020, is nevertheless expected to return to third place by 2023, irrespective of the scenario.

In addition, this group of the top five destinations becomes more significant in relative terms, in 2021 at least, as the scenarios change from mild to medium and then to severe. |

| Over the years to 2023 however, this group tends to return to almost pre-COVID-19 relative shares.

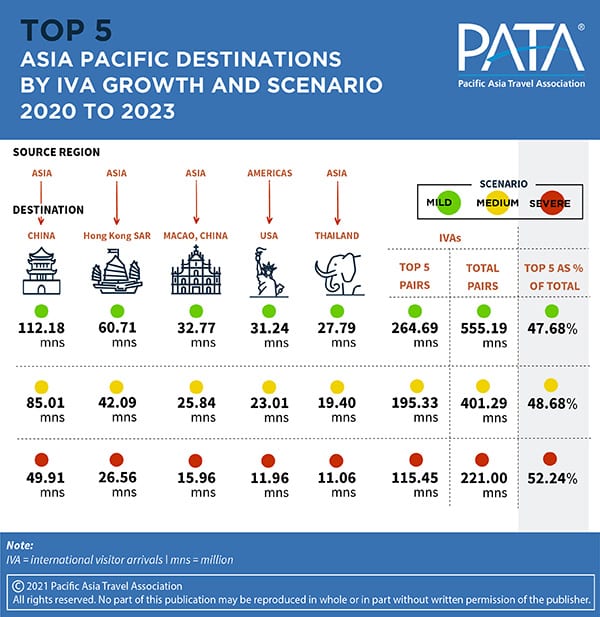

Over the longer period, the top five source region and destination pairs by volume increase between 2020 and 2023, are expected to remain in the same rank order under all three of the scenarios although the increase in the absolute number of foreign arrivals obviously changes. |

| The top five group increases in relative importance as the scenarios change, moving from almost 48% of the total IVA increase under the mild scenario to 49% under the medium and 52% under the severe scenario.

PATA CEO Dr Mario Hardy stated, “Calendar year 2021 is likely to be difficult for most destinations, with almost 40% of the 39 destinations covered in these forecasts falling even further from the low point of arrival numbers in 2020, even under the mild scenario. In the case of the medium scenario, that proportion is likely to increase to 85% while under the severe scenario it could well be the case for all 39 destinations.” “Clearly, a further round of belt-tightening will be needed in the international sector, with more innovation being required in developing what is available in the domestic sector,” he added. Dr Hardy concluded by reminding the travel sector that, “Vaccines are becoming more freely available and inoculations are proceeding rapidly, but even so, and while first results are very encouraging, their effectiveness over a wider proportion of the population has yet to be fully demonstrated. It is very likely that travellers in the future will have to carry proof of inoculation and being COVID-19 free, something that various agencies and airlines have been developing and is already trialling. Whatever the outcome, travel will never be the same again and we have no choice but to adjust and adapt to that.” |