What has the impact been on the travel and tourism industry as a result of the war created by Russia’s attempt to overtake Ukraine?

Predictably, sanctions and the ban on direct flights between Russia and most of the EU has dramatically reduced Russia’s air connectivity with the rest of the world. However, the Middle East and Turkey, which have not banned flights to and from Russia, have benefitted from a rise in air traffic to them and through them. In the year following the war, seat capacity between Russia and the Middle East was 27% greater than it was in the equivalent period before the pandemic and Turkey 26%. By comparison, it was 99% less to the EU and UK, 92% less to North America, 87% less to Asia Pacific, 76% less to Africa and the rest of the Americas and 20% less to the rest of Europe.

It has been one year since Russia’s invasion of Ukraine, and ForwardKeys has analyzed the impact of the war on travel. It reveals a number of trends, some expected and others surprising.

Perhaps the most surprising trend to emerge during the first ten months of the war, was wealthy Russians returning to international travel with a vengeance post pandemic, whereas ordinary Russians stayed at home. From the start of the war on 24th February until the end of December, premium class tickets for Russian outbound travel boomed, up by 10% on pre-pandemic levels. By comparison, economy class travel was down by 70%. However, from the start of 2023, the situation has changed, with international travel collapsing in the first quarter of the year. As of 15th February, premium class flight bookings for Q1 are currently 26% behind 2019 levels and economy 66% behind.

The destination which was most successful in attracting affluent Russians was Thailand.

Here, premium class travel was up by 81% on 2019. It was followed by the UAE, up 108%, Turkey, up 41%, the Maldives, up 137% and Egypt, up 181%.

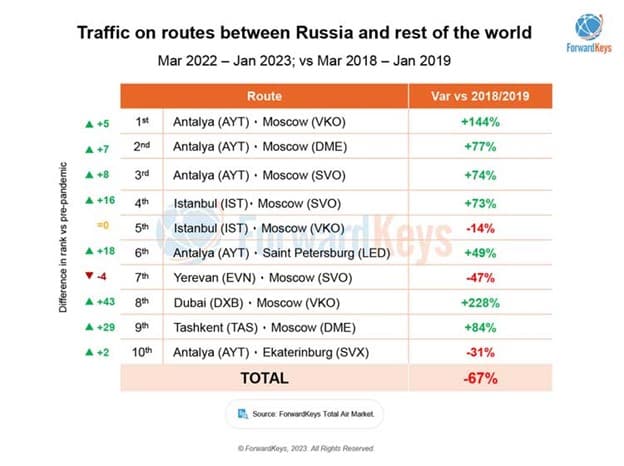

Looking at all travel, i.e.: premium plus economy, the picture is different. The most popular route for Russians during the past year has been to and from Antalya, the Turkish riviera resort. Flights there from Moscow’s three major airports, Vnukovo, Domodedovo and Sheremetyevo, were up by 144%, 77% and 74% respectively, compared to pre pandemic levels. The next busiest route was between Istanbul and Moscow Sheremetyevo, up 73%, and Vnukovo, down 14%. The sixth busiest route was between St Petersburg and Antalya, up 49%. It was followed by Yerevan – Moscow Sheremetyevo, down 47%, Dubai – Moscow Sheremetyevo, up 228%, Tashkent – Moscow Domodedovo, up 84%, and Antalya – Ekaterinburg, down 31%.

One further notable impact of the war in Ukraine, and the closure of Russian air space to many airlines, has been the increase in costs and flight times between Europe and Asia Pacific. Those costs have been passed on in the form of higher air fares, which have also been influenced by the late reopening of Asian destinations. In the year following the start of the war, average air fares between Europe and Asia Pacific were 20% higher than before the pandemic in 2019 and 53% higher than last year. On flight times, 37% of air traffic between the two continents now takes more than eight hours, up from 23% before the invasion. Routes that have been worst affected include those between Japan and South Korea in Asia Pacific and France, Germany, Scandinavia & the UK in Europe.

Olivier Ponti, VP Insights, ForwardKeys, said: “The greatest impact on air travel to and from Russia since the invasion of Ukraine last February has been war-related sanctions, which have particularly benefitted Turkey and the Middle East, as they have maintained direct flights to and from Russia. We expect Chinese airlines will be another winner as they are still flying through Russian air space; and that gives them a competitive advantage in flight times and fuel costs on routes between Europe and Asia Pacific. However, the most eye-opening feature is the premium class boom, which appears to illustrate a division in Russian society between the rich, who holidayed in style, while the less affluent stayed at home.”

Author: Olivier Ponti, VP Insights, ForwardKeys