When it comes to hotel development across Africa, Egypt and Marriott are the two phenomena to watch. This insight comes from this year’s African Hotel Chain Development Pipeline report, widely acknowledged as the industry’s most authoritative source, documenting and analyzing the number of hotels being planned and built across the continent.

The survey, conducted by Lagos-based W Hospitality Group, in association with the Africa Hospitality Investment Forum (AHIF), is based on responses from 45 global and regional (African) hotel chains, reporting on a pipeline of hotel development activity totaling around 84,400 rooms in 482 hotels, in 42 of Africa’s 54 countries.

North Africa continues to dominate the pipeline, with Egypt far ahead. It alone numbers 21% of the hotels and 30% of the rooms being planned or built on the entire continent.

West Africa’s share of the total is slightly down this year, despite having the largest number of countries. After several years of slumber, Central Africa is increasing its share, particularly in Cameroon and the Democratic Republic of Congo (DRC).

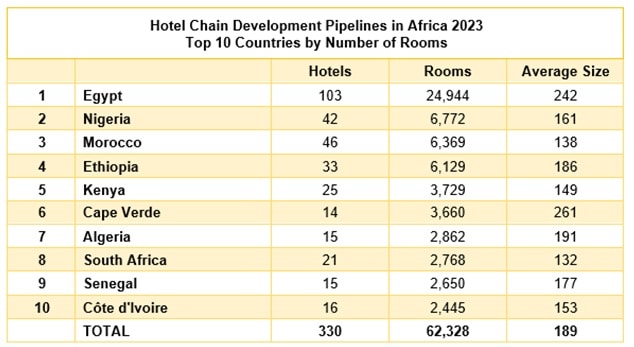

The top ten countries represent 68% of hotels in the survey, and 74% of the rooms.

Egypt not only leads the country table, with almost 25,000 rooms in 103 hotels, but is streaking ahead of the pack, with more than three times the number of rooms being developed in second-placed Nigeria, and four times Morocco and Ethiopia.

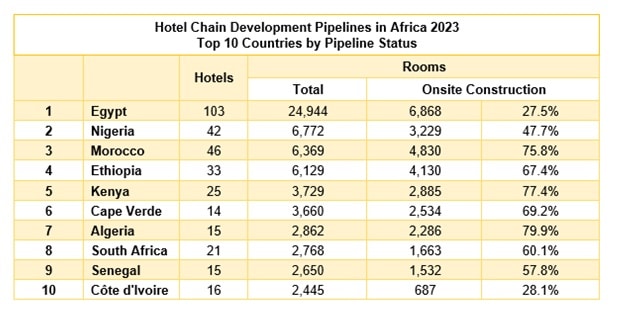

Despite its clear leadership in the absolute pipeline numbers, Egypt has the lowest percentage of rooms onsite due to its relatively “young” pipeline. Of the total 103 projects, half were signed in 2020 and later, and that’s nearly 60% of the rooms.

In contrast, Morocco and Algeria have some of the highest ratios of rooms under construction on the continent. After Egypt, Nigeria has quite a low percentage onsite, and, of the 22 hotels that have started construction there, eight of them, with about half of the “onsite” rooms, have stalled (often due to a lack of funds) and the sites are closed.

On a city basis, Greater Cairo has by far the largest share, 12% of the entire pipeline, followed by Sharm El Sheikh and Addis Ababa.