In spite of rising prices and a complex and uncertain economy, consumers are shopping and, in many cases, increasing their spend.

Inclusive Not Exclusive

Yes, the economy is uncertain. Yes, we are still experiencing inflation. Yes, in many cities, and business sectors, discrimination against age, race, religion, and sexual preferences not only remains but grows. Today, many shoppers are directing their cash to what is joyful and beautiful.

Joy in Spending

Worldwide, the beauty industry is predicted to exceed $716 billion by 2023 and $784.6 billion by 2027 (NPRD/IRI data). What is motivating shoppers to shop? What are they buying?

The beauty industry embraces what is unique, exceptional, different, and special, and because it employs an “inclusive” business model it could become a winning template for all industries losing market share.

The beauty segments are steeped in emotion as beauty brings joy (a universal aspiration) providing experiences that can be classified as play; activities that do not have a purpose other than helping us feel relaxed and happy, keeping our minds focused in the present. The present is where joy lives (mindbodygreen.com).

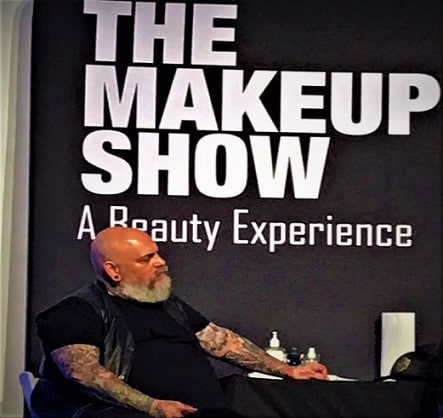

A key part of the beauty industry is the human touch. From a beauty consultant helping shoppers find the perfect color in a crowded display, to the retail buyer who acts as an editor selecting an assortment for the tastes and interests of customers, this is a people business. The human interaction is one of the most compelling reasons consumers continue to frequent shops (i.e., Sephora), roam the cosmetic counters at department stores and pharmacies (i.e., Macy’s and Duane Reade), attend pricey cosmetology classes, and applaud and follow makeup artists (i.e., Sarah Tanno/Lady Gaga, Gucci Westman/Reese Witherspoon, and Jennifer Anniston).

Every product and retail success has a human in the front or side of the item; someone who has discovered, refined, and/or created an OMG beauty item or look or created a captivating retail environment. Industries have been overrun with algorithms and data; however, there continues to be a need and a want for the human touch.

The industry is a platform for executives who are willing to take a leadership position. Many owners/managers are making bold moves, including adding services to a drug store dominated by household necessities, or heading into the unknown with an innovative product that is counterintuitive, bucking conventional wisdom.

Is It Worth It?

Larissa Jensen, vice president and beauty industry advisor to the NPD Group determined that 70 percent of consumers who indicate they are watching their spending are NOT reducing beauty purchases. On average, Americans spend between $244 and $313 on cosmetics every month.

Progress

In makeup, lip gloss is the fastest-growing sector, outperforming lipstick. Body skin care products grew at more than three times the rate of facial products while fragrance sales increased in the areas of eau de parfum, parfum, and high-end artisanal fragrance juices.

Searching for Fresh and Hygienic

Clean is a driving factor in the beauty buying decision. With no clear definition of clean, shoppers are doing their own research; however, 40 percent rely on retailers to classify products for them. Clean was supplanted during the pandemic by CLINICAL – but clean is rebounding.

Vegan and cruelty-free are keywords consumers spot when looking over reviews. Social responsibility percolates to the top of a shopper checklist with 34 percent of consumers indicating that this attribute is important (NPD).

Ingredients

Women do not want products that contain animal-derived ingredients, parabens, phthalates, mineral oil, gluten, or dyes. Multicultural consumers look to well-established brands of skin care products with natural, certified organic, and ethically sourced ingredients.

Multicultural

In the USA, the female beauty shopper is multi-dimensional and multi-cultural; this is good news for the beauty industry. According to estimates, 129 million multicultural consumers now represent 40 percent of the population and these consumers are responsible for driving nearly all of the US population growth over the last five years. Over 120 million strong and increasing by 2.3 million per year, multicultural populations are the growth engine of the future in the U.S.

Black and brown women already spend approximately $7.5 billion annually on beauty products and the number is projected to grow. According to research from Packaged Facts, the buying power of African Americans has surpassed $1 trillion.

Hispanics, African Americans, Asian Americans, and all other multicultural groups already make up 38% of the U.S. population, with Census Bureau projections showing that multicultural populations will become a numeric majority by 2044.

Committed

Multicultural women, especially Hispanic women, are more committed to beauty routines and trying new products than other women. Acknowledging this fact, brands are responding by introducing new skincare, putting less emphasis on lightening skin tones with a higher priority on products and services that help users achieve a healthy, clear complexion. Latino women in the US report creating complex makeup looks compared to 51 percent of all women, while African American women trend toward embracing a natural beauty appearance (Mintel). In the near future, people of color will represent a majority in America and the beauty industry is positioning itself to capitalize.

Manly Makeup

A research study supports the hypothesis that subtle cosmetics make male faces look more attractive (Batres, C., & Robinson, H. 2022). The men’s makeup market is estimated to reach $276 billion by 2030. The growing trend toward skincare, haircare, and fragrance products among men is thanks to significant brand endorsements by celebrities, encouraging men to purchase cosmetic brands.

Danny Gray, Founder of beauty brand War Paint claims that men, “feel ashamed about using make-up” and studies find that only one in a hundred men wear makeup on a daily basis.

A significant challenge is the small number of specific male-dedicated products. Makeup is frequently designed to be inclusive and education is needed for male consumers to learn why they should select a male-specific product rather than something viewed as unisex. Studies should highlight the fact that men’s testosterone (on average) makes their skin 25 percent thicker than females. In addition, men’s skin produces more sebum resulting in it becoming more acne-prone and oily.

Start Early

Research suggests that 42 percent of men first started practicing skin care between 15-17 y/o; however,